Tax and Legal Implications of Trading with a Funded Crypto Account

“Your gains are only as good as your compliance.”

Over the past few years, the world of proprietary trading has collided head‑on with the fast‑moving crypto space. Imagine you’re trading Bitcoin, Ethereum, or even tokenized commodities—not from your own capital, but from a funded account provided by a prop firm. It feels like skipping the climbing wall and heading straight to the summit. But here’s the catch: the moment you start earning, tax offices and regulatory bodies want their slice, and the legal structure of your trades can get complicated fast.

Understanding the Structure of Funded Crypto Accounts

Funded trading programs have long been popular for forex and equities, and they’ve paved the way for crypto to join the lineup. The concept is simple: the firm gives you buying power, you trade under their rules, and profits are split. The twist? In crypto, there’s often no centralized clearinghouse, and trades may occur on decentralized exchanges, across borders, and under conditions where the “custody” of assets is murky.

Example: Say you’re a U.S.-based trader working with a European prop firm. Your trades in Ethereum may clear via a Singapore-based exchange, and the PnL is calculated in USDT. Now you need to ask—whose laws apply? Which tax jurisdiction claims those profits? A chunk of your edge can vanish if you misread that answer.

Tax Realities You Can’t Ignore

The IRS, HMRC, and most revenue agencies view cryptocurrency gains just like any other capital gain. That means:

- Short-term gains (assets held less than a year) get taxed at ordinary income rates.

- Long-term gains enjoy lower rates but still need full record-keeping.

- Income vs. capital gains: Many funded account payouts are classified as contractual income, not investment returns, which can tip you into a higher bracket.

In practical terms: a funded crypto trader who scales up and earns $100k might find that after federal tax, state tax, and possible self-employment tax, the take-home is much slimmer than expected. And in jurisdictions with VAT or GST, the prop firm’s cut might also involve indirect tax liability.

Legal Framework and Regulatory Shadow

Lawyers often call the funded crypto trade environment a “multi‑jurisdictional puzzle.” Crypto adds layers: smart contracts may execute trades automatically, but legal responsibility still falls on the party whose wallet initiated the transaction.

If the prop firm’s liquidity comes from decentralized lending pools, the assets may be exposed to risks like protocol exploits. While traditional forex prop rules are clear, crypto prop rules vary—sometimes wildly—by country:

- KYC/AML obligations may shift depending on whether trading occurs on centralized vs decentralized platforms.

- Cross-border capital flow laws could apply if profits are sent internationally.

- Securities classification: In some countries, certain tokens or DeFi products are treated as securities, triggering licensing requirements.

Growth of Prop Trading Across Assets

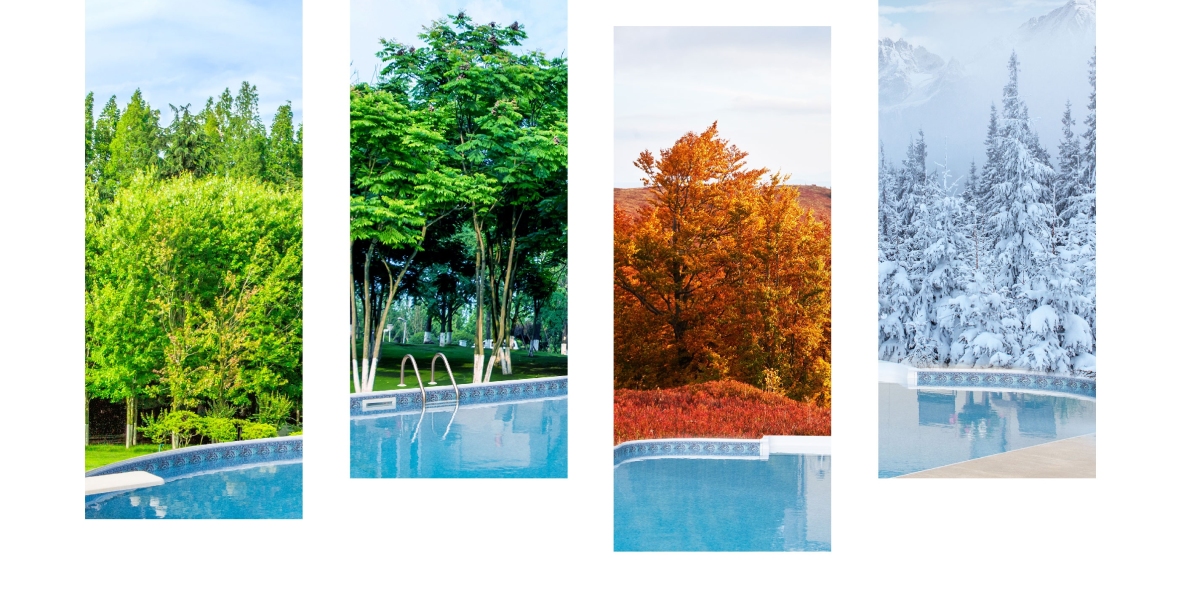

Part of the excitement here is that crypto is just one tile in the mosaic. Modern prop firms let traders move between forex pairs, equity indices, commodities futures, options—and now Bitcoin or Solana—within the same umbrella account. The advantage? Skills transfer. The same technical discipline you built scalping EUR/USD can apply to ETH/USD, and risk management principles cross borders even when tax rules don’t.

This multi‑asset flexibility is a selling point: traders learn correlation plays, hedging techniques, and volatility navigation, which helps ride out bad trades. It’s like having a multilingual portfolio—your market language adapts to the environment.

The DeFi Twist

Decentralized finance promised democratized access: no intermediaries, lower fees, and global liquidity. But the tax man didn’t disappear. DeFi options can make tracking gains harder—yield farming and staking payouts blur the line between capital and passive income. For funded accounts, firms often rely on hybrid models—holding liquidity in DeFi pools for yield, but executing trades in tradable pairs on centralized exchanges for compliance.

The challenge? Transparent auditing. Traders need trade logs that satisfy both internal performance evaluation and revenue agency audits. No one wants a brilliant trading record wiped out by inability to prove asset origin.

Looking Ahead: Smart Contracts, AI Trading, and Regulation

Smart contract execution and AI-driven market analysis are reshaping prop trading. Imagine a funded crypto account that auto‑adjusts your lot size based on live volatility and your historical win rate, coded into an intelligent portfolio manager. This could potentially streamline compliance: transactions would auto‑record with tax metadata.

Regulators are catching on—some countries already drafting frameworks to integrate AI and smart contracts into acceptable reporting standards. This could mean an eventual merger between instantaneous blockchain settlement and pre‑approved tax reporting formats.

Strategy Notes for Traders

- Keep personal and funded account activity clearly separated; intermixing assets can cause taxable confusion.

- Use tax‑friendly jurisdictions for receiving payouts if your work is legal there.

- Track trades in real‑time accounting software—waiting until filing season to reconstruct blockchain addresses is a nightmare.

- Understand the prop firm’s contract: does your payout count as “wages,” “independent contractor income,” or “investment profit”? It matters more than you think.

Closing Thoughts

Trading with a funded crypto account is as much about navigating tax codes and legal frameworks as it is about reading charts. For those willing to play the long game, the fusion of multi‑asset prop trading, decentralization, and AI’s rise offers a stage where skill and compliance carry equal weight.

Slogan: “Trade bold, report smart—because winning in the market means surviving the ledger.”

If you want, I can also make a shorter, high-conversion version of this for social media, so you can target traders directly. Do you want me to do that next?